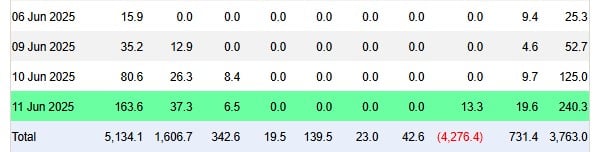

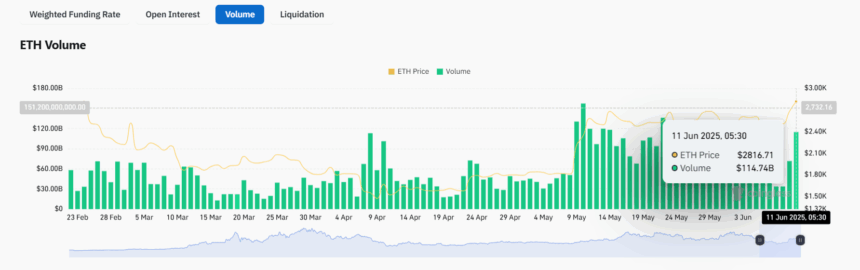

In its prime run, Ethereum has continued making headlines with it surpassing Bitcoin in another key metric by recording a 24-hour derivatives trading volume of $114 billion, significantly higher than Bitcoin’s $80 billion on 11 June.

This shift comes while spot Ethereum recently outpaced Bitcoin in spot ETF inflows, largely due to increased institutional inflows, and as ETH prices keep breaking barriers, which have soared over 54% in a rally begun on 7 May.

As per Coinglass data, the 24-hour trading volume for Ethereum perpetuals hit $114.74 billion, with its total open interest (OI) surging to a record high of $41.67 billion—reflecting high speculations for ETH’s upward trajectory.

Bitcoin, which usually dominates the crypto markets in every aspect, has been outshined by Ethereum since the past few weeks. While most of the market chatter and headlines surround Bitcoin, Ethereum has fundamentally upscaled with major developments this year. Its aim of a DeFi-focused ecosystem has matured notably, with it still dominating the market with a significant share.

ETH Price Continues Soaring

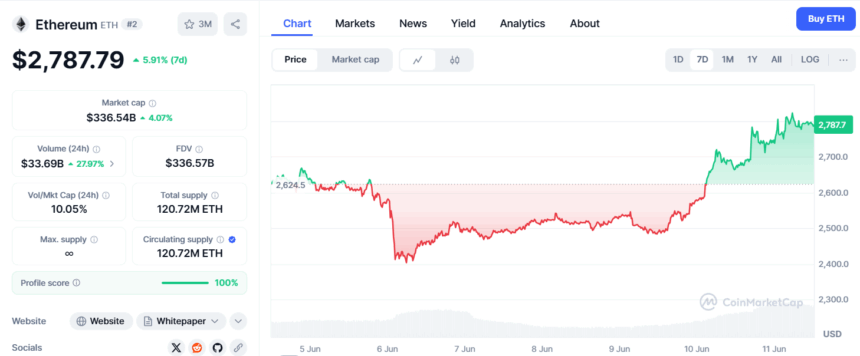

All this traction has led Ethereum (ETH) price to surge with sharp gains. Over the past month, the ETH price has broken through multiple barriers, positioning itself as one of the top-performing blue-chip crypto assets.

At the time of writing, ETH is trading near $2,787—up 5.91% in the past 24 hours. Its daily trading volume has seen a boost of 28%, which currently sits at $33.69 billion.

The next few months will be crucial for Ethereum as it embarks on a new journey to challenge Bitcoin in various aspects. Analysts are expecting it to break above $3,000 by this month, while anticipations are around it recording a new all-time high by the year’s end.