The 24-hour trading volume for decentralized exchange (DEX) aggregator 1inch has set a new all-time high (ATH), with it surging to a staggering $7.26 billion on 9 June. This milestone has sparked speculation of an impending “DeFi Summer,” echoing the 2021 boom.

The volume surge in 1inch coincides with a stark spike in the broader crypto market activity, with Bitcoin marching towards a new all-time high and Ethereum (ETH) continuing its bullish momentum.

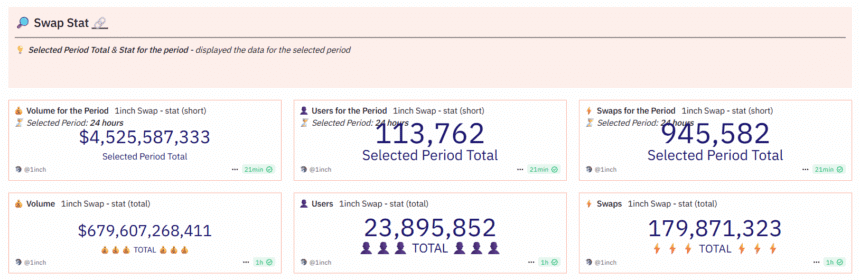

As per Dune analytics data, the 24-hour volume for 1inch currently sits at $4.52 billion, with its cumulative trading volume hitting $649.60 billion today. It has executed 113,762 transactions in the past 24 hours.

Hints for DeFi Summer?

Various users are aligning 1inch’s this milestone with potential DeFi Summer, where DeFi market activity peaks and surpasses volumes on centralized crypto exchanges. The 2021 DeFi Summer saw decentralized exchanges and aggregators, including 1inch, command over 80% of on-chain volume, driven by yield farming and emergence of new protocols.

With DeFi’s market share at 20.5% and daily DEX volume at $12.8 billion, analysts see parallels—boosted by growing institutional adoption and retail FOMO.