The crypto market crashed after Israel carried out a surprise airstrike on Iran early in the morning, shaking global markets and dragging digital assets down with it.

Within hours, over $1.15 billion in crypto liquidations were wiped out across major exchanges. Bitcoin dipped below $104K, but it wasn’t alone. Altcoins were hit just as hard, if not harder, as the geopolitical tremor quickly turned into a full-blown market rout.

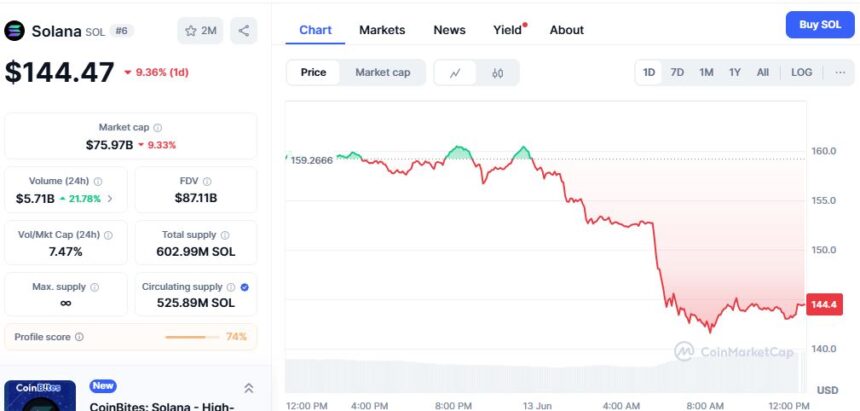

Solana (SOL)

Solana was one of the biggest casualties of this crash. It dropped over 9% to $144.47 in a steep fall that wiped out $52.56 million in open positions. Of that, $46.14 million were long trades, traders betting on the upside who got completely rekt.

The market cap values at $75.97 billion, and the 24-hour trading volume on Solana spiked to $5.71 billion, up more than 21%, showing how intense the exit was. What started as a sharp dip turned into a full liquidation cascade, especially on high-leverage plays.

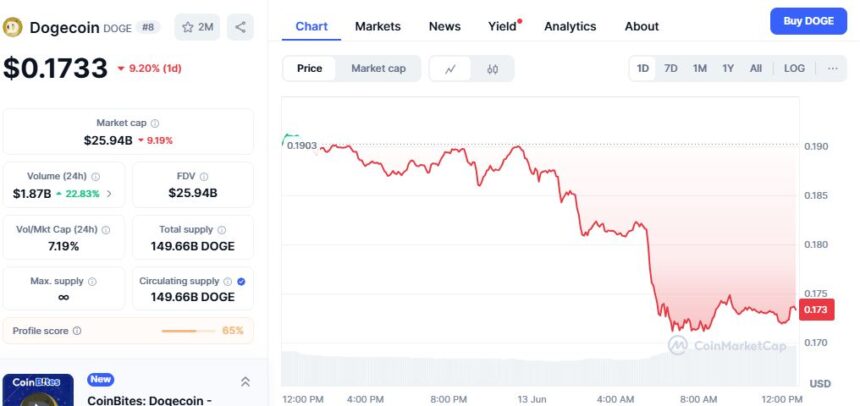

Dogecoin (DOGE)

Dogecoin, despite its meme status, wasn’t spared either. The memecoin dropped 9.20% to $0.1733. Around $26.14 million was liquidated in 24 hours, with longs again taking the major hit at $24.44 million. Dogecoin had seen a mini revival recently, but the crash knocked it back down fast.

The market cap currently stands at $25.94 billion, and 24-hour trading volume jumped to $1.87 billion as traders rushed to cut losses. The same retail crowd that often props it up was now on the other side of the trade, forced to sell.

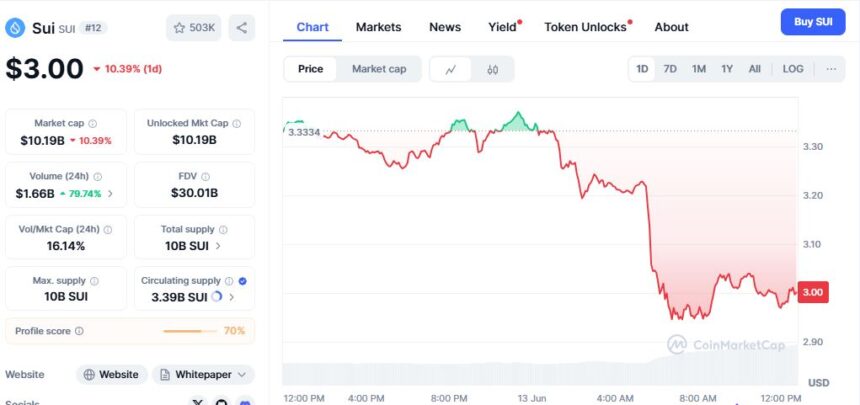

Sui (SUI)

Sui took one of the sharpest hits in percentage terms. Down nearly 11%, it now trades at $3. Over $13.4 million worth of positions were liquidated in the crash, $12.6 million of them were longs. Sui had been on a bit of a run before the crash, but its thin order books made it especially vulnerable.

Its market cap dropped to $10.19 billion, and trading volume jumped 79% to $1.66 billion as traders scrambled to escape collapsing setups. It’s the kind of altcoin that runs when risk is on, and sinks fast when it’s not.

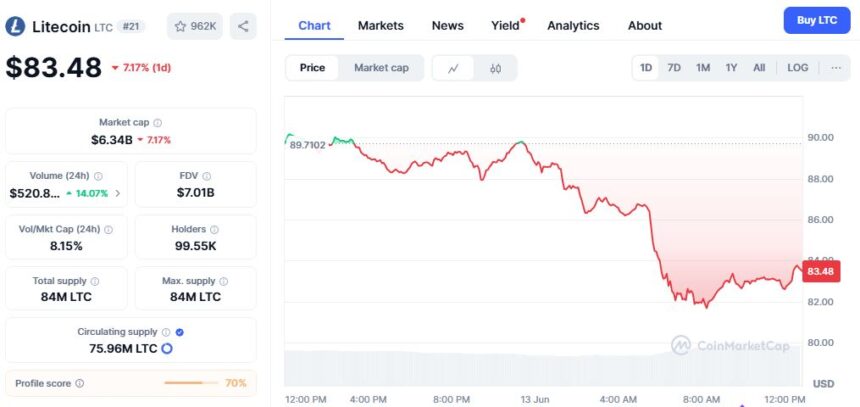

Litecoin (LTC)

Litecoin, which usually flies under the radar during big market moves, also got dragged into the storm. It dropped 7% to $83.48, with $4.13 million in liquidations. Most of it, $4.04 million, came from long positions. Litecoin had been fairly stable over the last few weeks, but once the broader market turned red, it followed.

Volume increased by 14.07% to $522.97 million, and the market cap values at $6.34 billion as LTC holders moved quickly to reduce exposure.

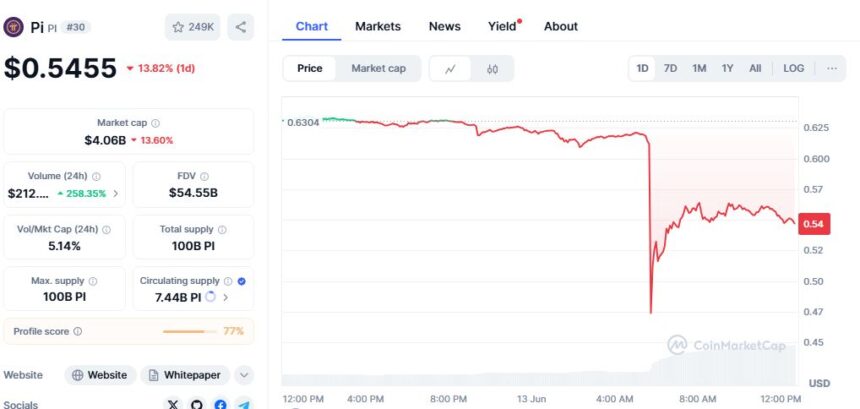

Pi Network (PI)

Pi Network isn’t usually in the spotlight, but it even got hammered. The token saw a brutal 13.82% drop, now priced at $0.5455. It saw a massive surge in activity, 24-hour volume spiked by over 250%, reaching $213.35 million. That kind of volume spike, paired with a double-digit price drop, signals nothing but panic.

The 24-hour trading volume currently stands at $212 million, pumping 258%, and the market cap dropped to $4.06 billion as traders dumped positions in fear of deeper losses.

This crypto market crash wasn’t technical, it wasn’t about ETFs, and it wasn’t triggered by a central bank comment. It was geopolitical, raw, real-world conflict spilling into digital asset prices.

After the strike, oil prices started climbing, gold spiked, and risk assets tanked. JPMorgan quickly warned oil could hit $120 if the conflict escalates, which could push U.S. inflation back up to 5%. That adds another layer of risk for crypto: macro uncertainty, rising inflation, and less room for the Fed to ease.

More than 247,000 traders were liquidated in this crash. The single biggest liquidation happened on Binance: a BTCUSDT position worth over $201 million. Long traders across the board got wiped out. The total crypto market cap is now down nearly 5% in a single day, sitting at $3.23 trillion.

This is what a real crypto market crash looks like: fast, unexpected, and brutal. No warning. No time to react. Just fear, volume spikes, and liquidation charts lighting up like Christmas.