Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has been a focal point for investors and analysts in 2025, with many speculating whether it can break the $5,000 barrier and set a new all-time high this year.

Since May 8, Ethereum price has surged by nearly 48%, accelerating from $1,790 to $2,675—where it is currently trading at. This sharp rally was largely fueled after the world’s largest asset manager, BlackRock, mentioned on the staked Ethereum ETF in one of its meeting agenda to the US SEC.

As Ethereum is now resting from the rally but still surging steadily, many analysts are expecting it to hit a new all-time high and surpass the psychological milestone of $5,000 in 2025.

Analyst Predicts Ethereum to Hit $4,800 Soon

On May 28, 2025, a prominent crypto analyst Javon Marks shared an optimistic outlook on X, predicting that ETH could soon hit $4,811—a 81% upside from its price at the time. The analyst believes that this push will potentially open the door to $8,500 levels if the momentum continues.

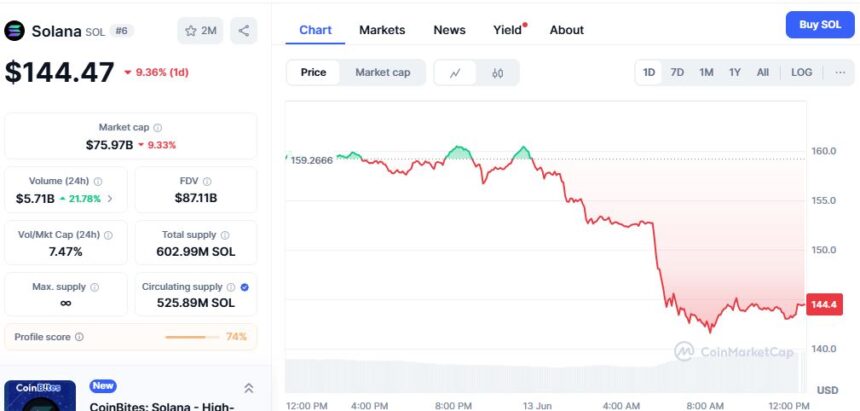

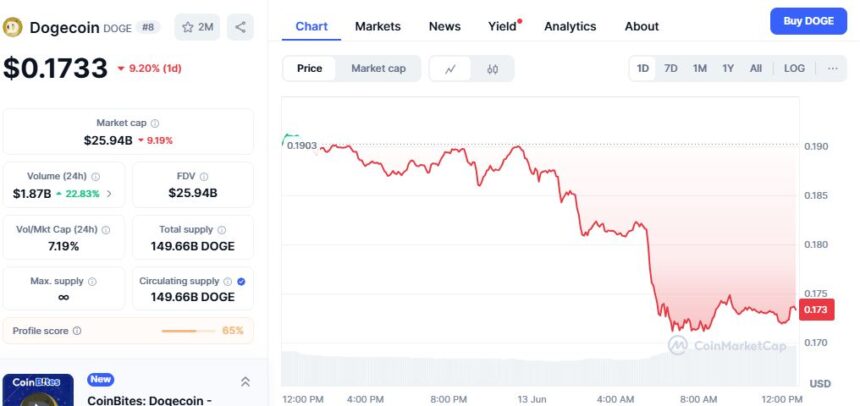

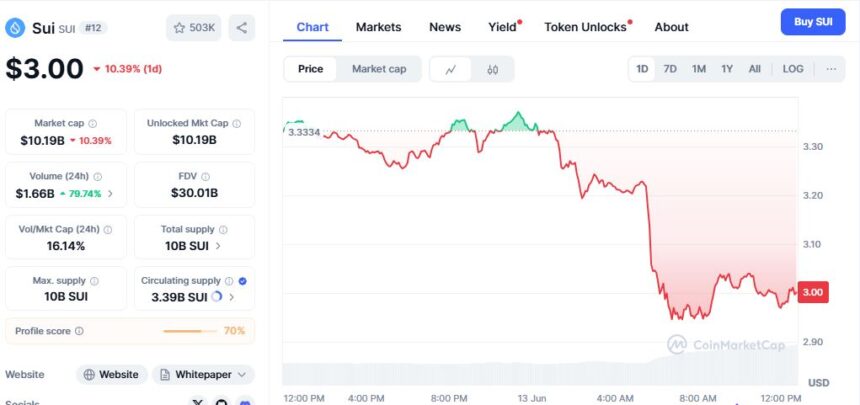

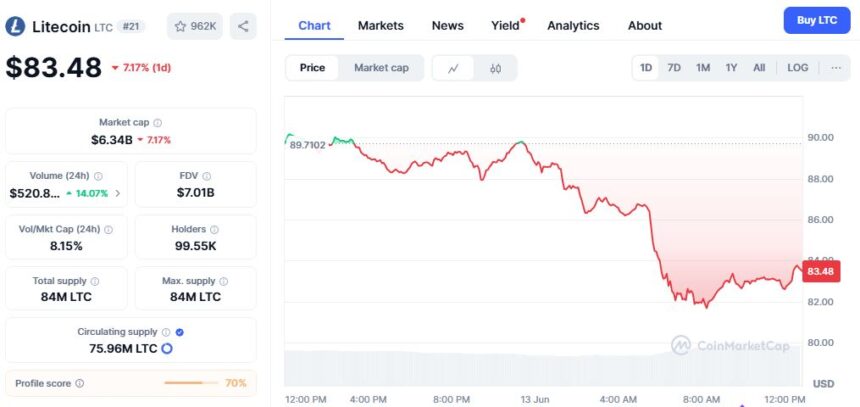

Marks’ analysis, rooted in a sustained breakout from a resisting trend since late 2022, suggests ETH’s price action could also catalyze growth across the altcoin market, with L1 altcoins like Solana (SOL), Cardano (ADA), Avalanche (AVAX) and other seeing a mammoth surge.

However, not all recent forecasts align with Marks’ bullish sentiment. Some recent speculations report a more cautious prediction and estimate ETH to trade between $2,400 and $2,900 in May 2025 while a possible rise to $3,000–$3,200 by August 2025.

Can Ethereum Break to a New High This Year?

The global crypto market cap currently sits at $3.44 trillion, with Ethereum dominating at 9.4% roughly. Market data shows Ethereum has a market cap at $332 billion and it is the second largest cryptocurrency.

The historical market data underscores ETH’s influence on crypto trends, often acting as a bellwether for altcoin movements, which aligns with Marks’ view that an ETH rally could trigger broader market growth.

So, can Ethereum break $5,000 in 2025? Well, the answer depends on a continuation of the rally, solid price action and technical breakouts. Yet, some recent forecasts and ETH’s volatile nature remind investors to tread carefully. With market dynamics evolving, ETH’s path to a new all-time high remains a high-stakes narrative to watch.